Introduction

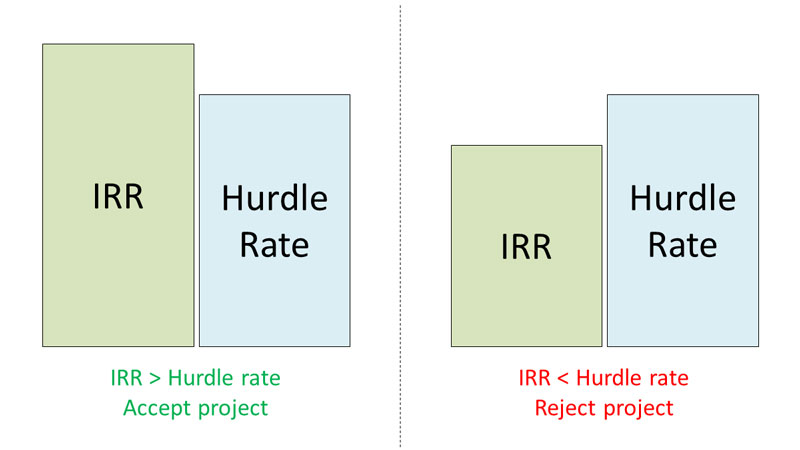

What Is a Hurdle Rate? The rate is set by looking at the cost of capital, the risks involved, the current opportunities for business growth, the rates of return on similar investments, and other variables that could directly impact an investment. Hurdle rates are very important in business, especially when planning for future projects and ventures. The level of risk that comes with a capital project tells a company whether or not to take it on. If the expected rate of return is higher than the threshold rate, the investment is thought to be a good one. If the interest rate begins to fall below the threshold, the investor may decide not to keep moving forward. A break-even yield is another name for a "hoop rate."

Hurdle Rate Usage

A premium is often added to a possible investment to show how risky it is expected to be. The interest rate should be higher if there is a higher chance of losing money. If you are more likely to lose your money, you should also get more money back. A risk premium is often added to the WACC to get a better hurdle rate. For example, a company with a "threshold rate" of 10% for acceptable projects would probably accept a project with an IRR of 14% and no major risks. If, instead, the cash flow of this project was discounted by the hurdle rate of 10%, the net present value would be large and positive, which should lead to the proposal being accepted.

Calculation of "Hurdle Rate"

Companies can buy back their shares instead of making a new investment, and the rate of return would probably be their WACC. The rate of return that investors want from a company is another way to look at the hurdle rate. A project the company puts money into must be worth at least as much as or more than its cost of capital. A better way is to look at the risk of each investment and add or take away a risk premium predicated on that. For example, if a company's WACC is 12% and half of its assets are in Argentina (a high-risk country), and the other half are in the United States, its WACC is 12%. (low risk)..

What's Wrong with a Hurdle Rate?

For instance, project A has a 20% return and a 10-dollar profit value. The return on Project B is 10%, and the dollar value of the profit is $20. It most likely has a higher rate of return, even though it gives back less money in total. The first component representing the criterion is the cost of borrowing or the WACC. All undertakings with the expected level of interest lower than their correlating stumbling block rates will incur losses. It same second component that represents the criterion is indeed the risk premium. Also, picking a risk premium is hard because there isn't a set number. An investment may bring in more or less than expected, and if the wrong choice is made, this could mean that money isn't used well or that opportunities are missed.

What the Hurdle Rate Means to the Average Investor

Investors use hurdle rates as a standard for judging investments. You can also use them to plan for your retirement and your finances. When planning for retirement and money, you need to set goals and make a plan to reach them. Depending on how well your investments do in the future, you'll need to save and invest different amounts in reaching your goals.

Conclusion

In a net present value method, investors use a "hurdle rate" to determine an investment's net cash flow value and decide if it's worth it. A break-even yield, another name for a hurdle rate, is a very important number in the business, particularly in plans and projects. The level of risk that comes with a capital project tells a company whether or not to take it on. If the expected return is higher than the threshold rate, the investment is thought to be a good one. If the rate of return falls below the threshold, the investor may decide not to move forward.

watch next